Tax Services

Renovating your tax strategy with a sustainable approach.

More Info

Cooper Norman utilizes a proactive approach to bring you comprehensive and innovative solutions. We utilize a multidisciplinary team of experts across all of our service lines to make sure you have the right resources and the right service team to guide you through the intricacies of your specific situation. Don’t miss important new strategies as the tax code evolves. Our team invests time and resources in making sure the latest laws and strategies are presented to you so you don’t have to do the research or worry about missing potential opportunities.

Menu of Services

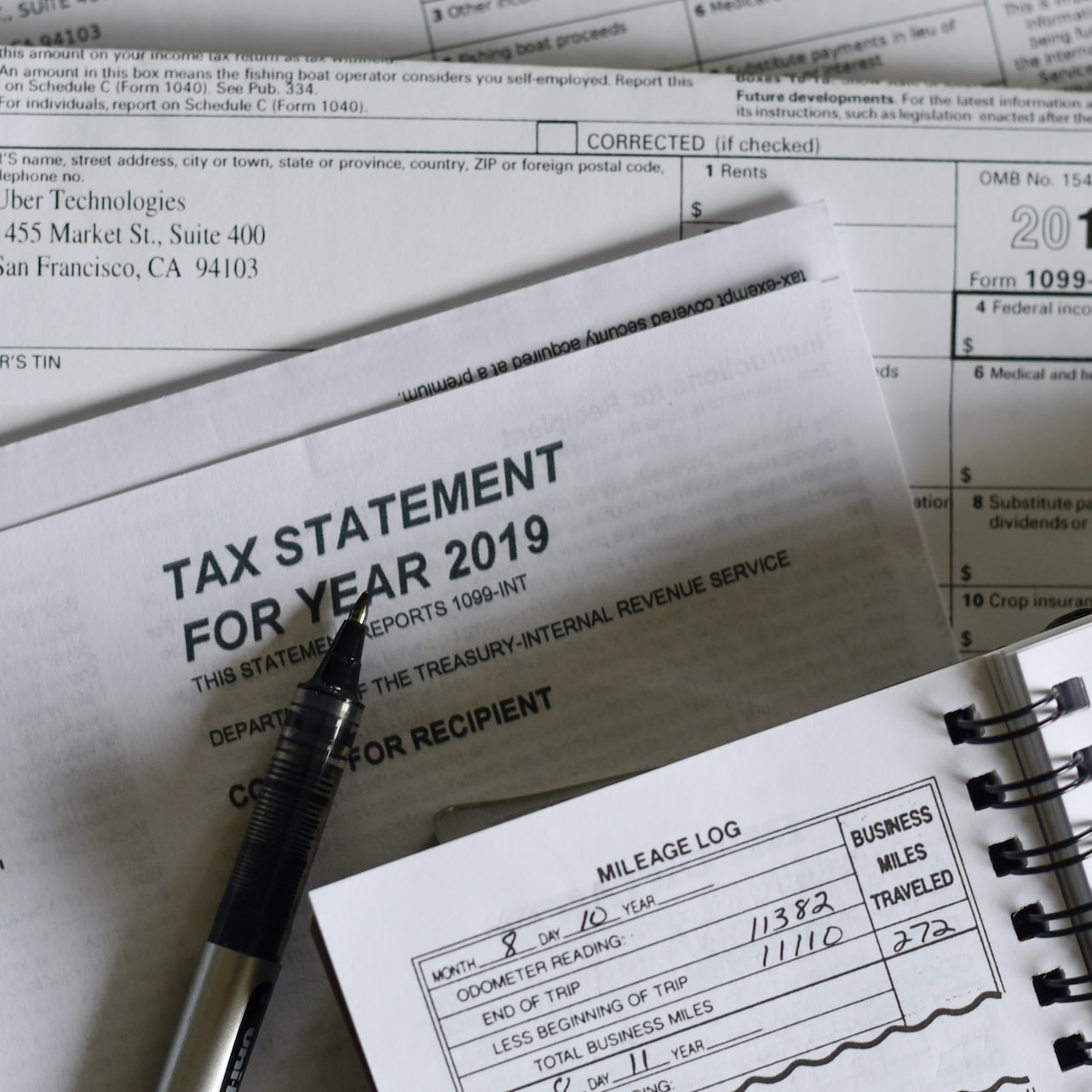

Tax Return Preparation

Tax Planning & Strategies

Entity Selection

Cost Segregation

Tax Credits

Multi-State Taxation

Sales Tax

International Taxation

IRS Audit Support

Payroll Tax

W-2 vs Independent Contractor

Like Kind Exchanges

Opportunity Zones

Reasonable Compensation Survey

Strategic Transaction Taxation

Industry Specific Tax Strategies

Gift and Estate Planning

Valuation Services

Idaho Falls

1000 Riverwalk Drive Suite 100

PO Box 51330

Idaho Falls, Idaho 83405

208.523.0862

208.525.8038 (Fax)

Pocatello

444 Hospital Way

Suite 555

Pocatello, Idaho 83201

208.232.6006

208.232.6007 (Fax)

Blackfoot

1495 Parkway Dr.

STE C

Blackfoot, ID 83221

Rexburg

859 South Yellowstone

Suite 204

Rexburg, Idaho 83440

208.523.0862

208.525.8038 (Fax)

Twin Falls

722 North College Road

PO Box 5399

Twin Falls, Idaho 83303

208.733.6581

208.734.9609 (Fax)

Boise

184 SW 5th Ave

Suite 100

Meridian, Idaho 83642